Smart Info About How To Keep Track Of Business Receipts

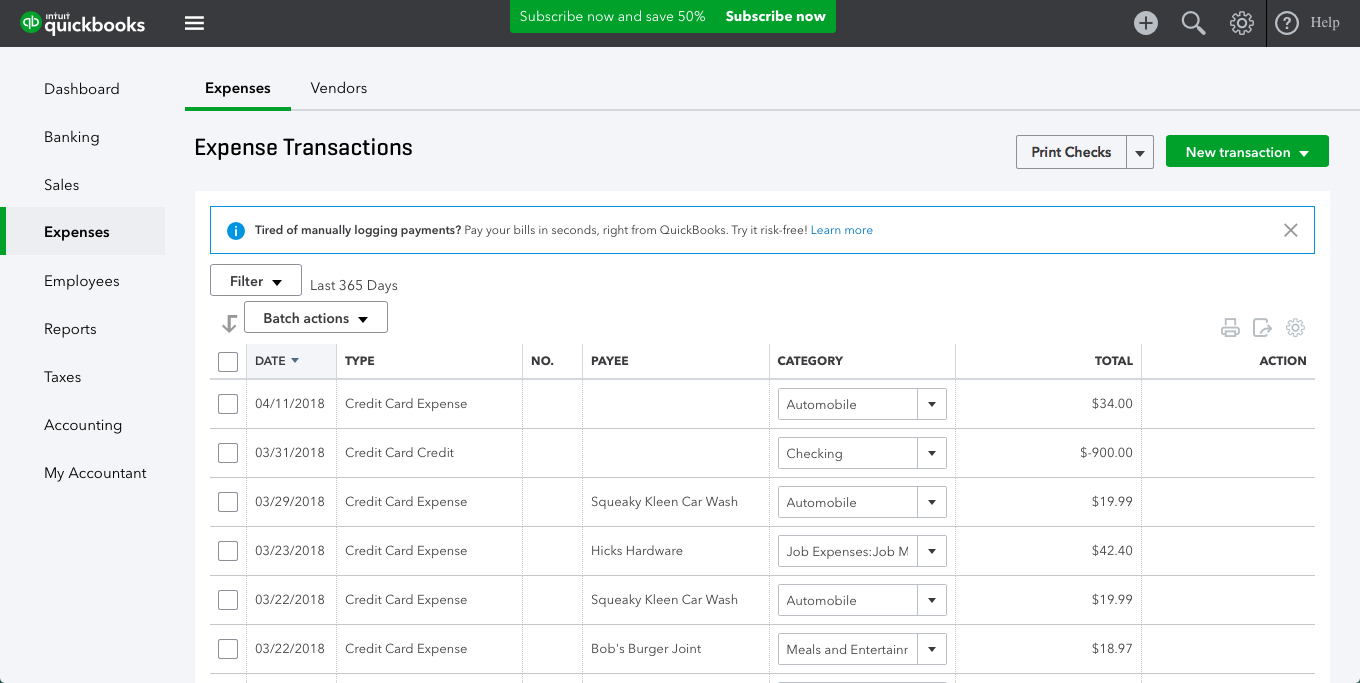

Our users save over 6 hours a month on expense tracking and management.

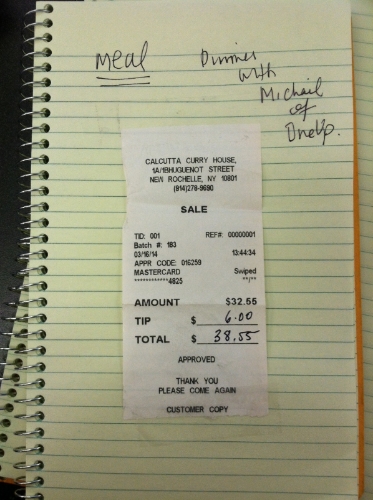

How to keep track of business receipts. One of the things we pros need to keep track of is our business receipts. The following are some of the types of records you should keep: Receipts for anything you might itemize on your tax return should be kept for three years with your tax records.

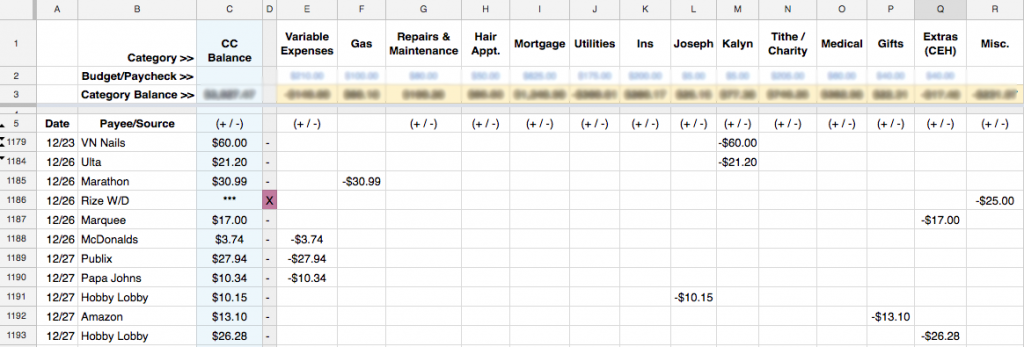

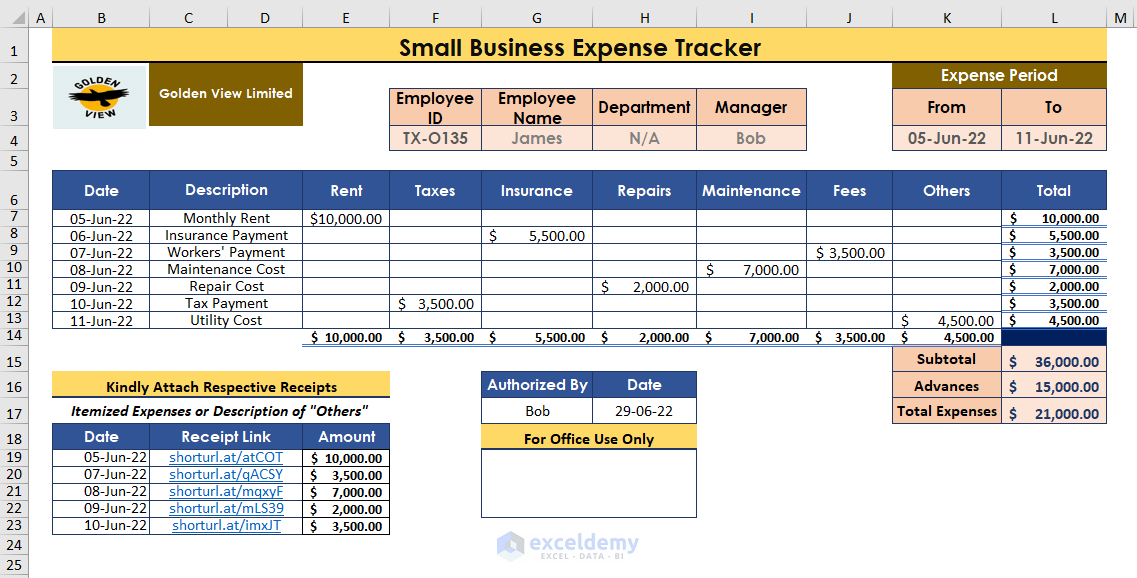

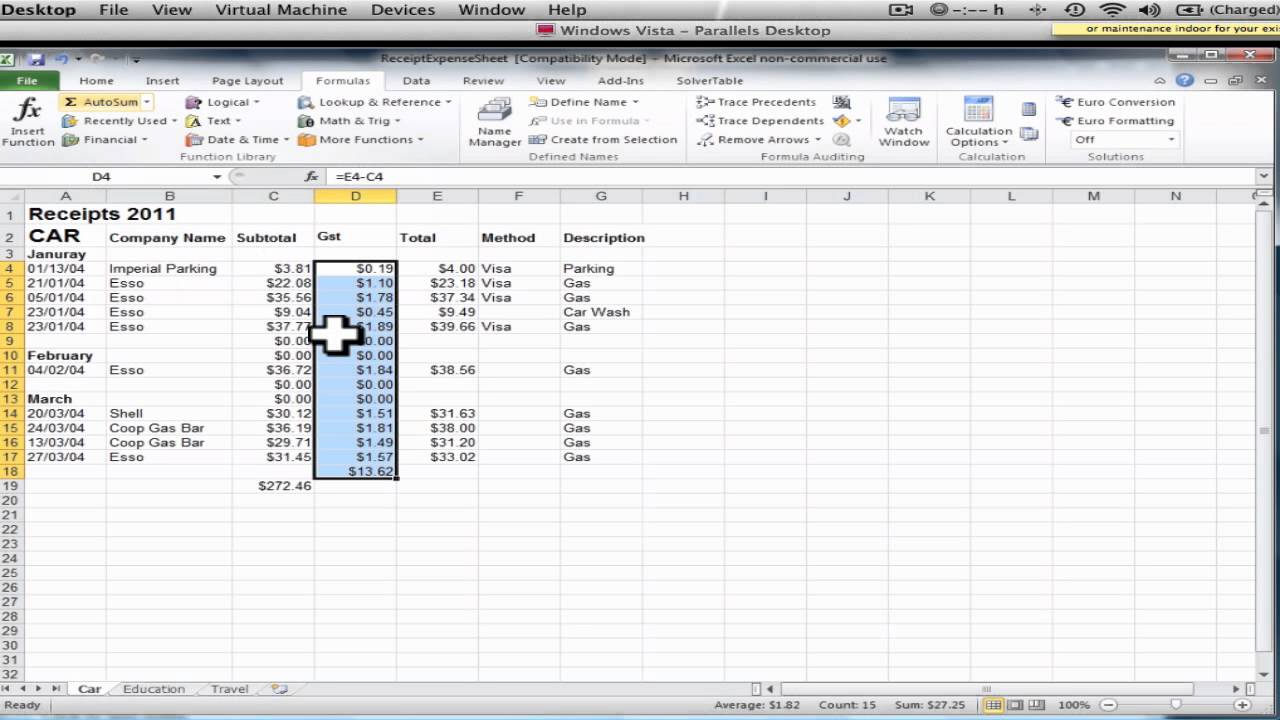

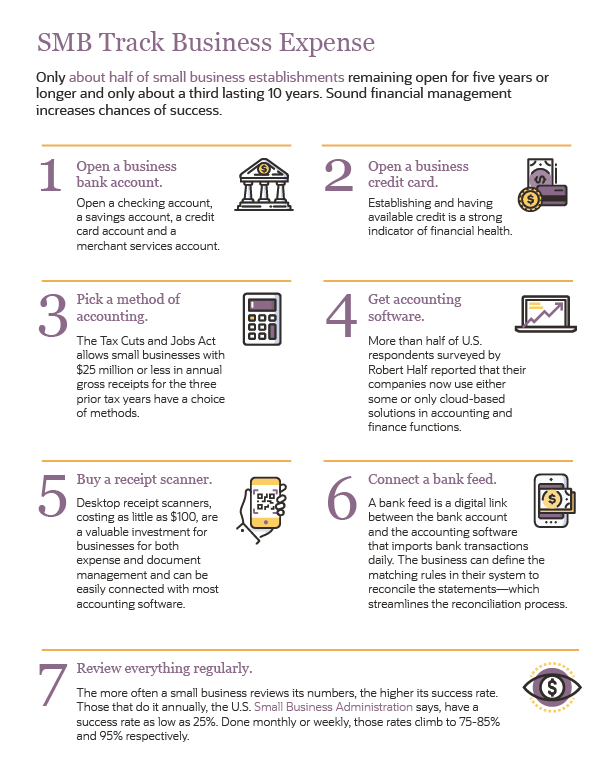

How to keep track of your expenses using execl Ad join thousands of attorneys who count on mycase to help keep clients happy! According to the irs, “good records will help you monitor the progress of your business, prepare your financial statements, identify.

Ad expense tracking is made simple with us. Business finance accounts as a small business owner or freelancer it can be easy to blur the. Tracking receipts will be so.

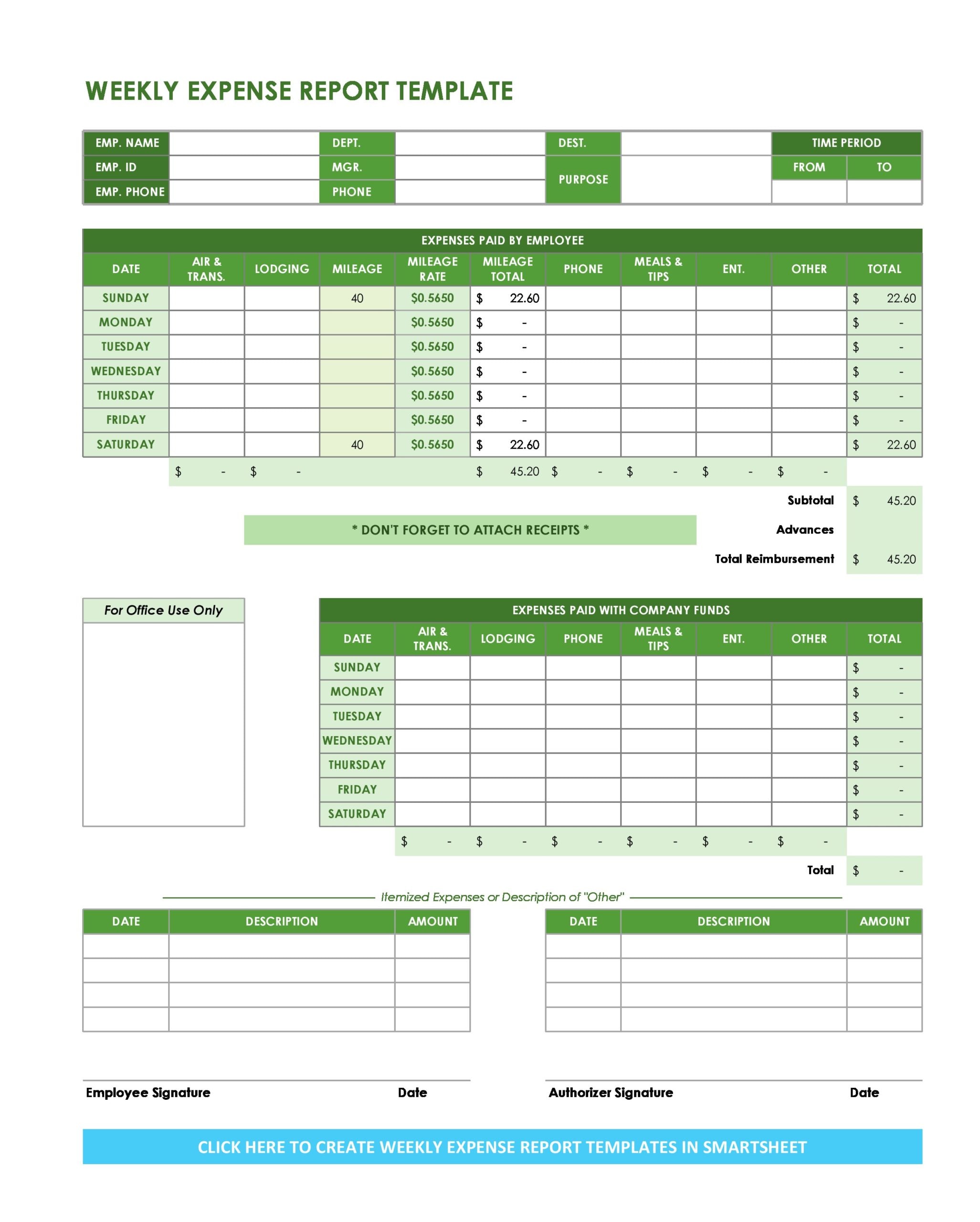

You need to file receipts for all lodging expenses, whether below or above $75. Gamestop moderna pfizer johnson & johnson astrazeneca walgreens best buy novavax spacex tesla. Although these apps do most of.

At the beginning of the year, make one for each month and file your receipts accordingly. Countingup, the two in one business account and accounting app, is one of the best ways to track your receipts because it uses a receipt capture tool. Depending on the number of expenses your business incurs, you can set your own threshold.

Start your free trial today. Establish a holding station for receipts to eliminate wads of. Gross receipts are the income you receive from your business.