Cool Tips About How To Reduce Federal Income Tax

The amount you stash in your 401 (k) directly isn’t taxed by the irs.

How to reduce federal income tax. Contribute to a retirement account. Here are 5 ways to reduce your taxable income 1. Out of sight, out of mind.

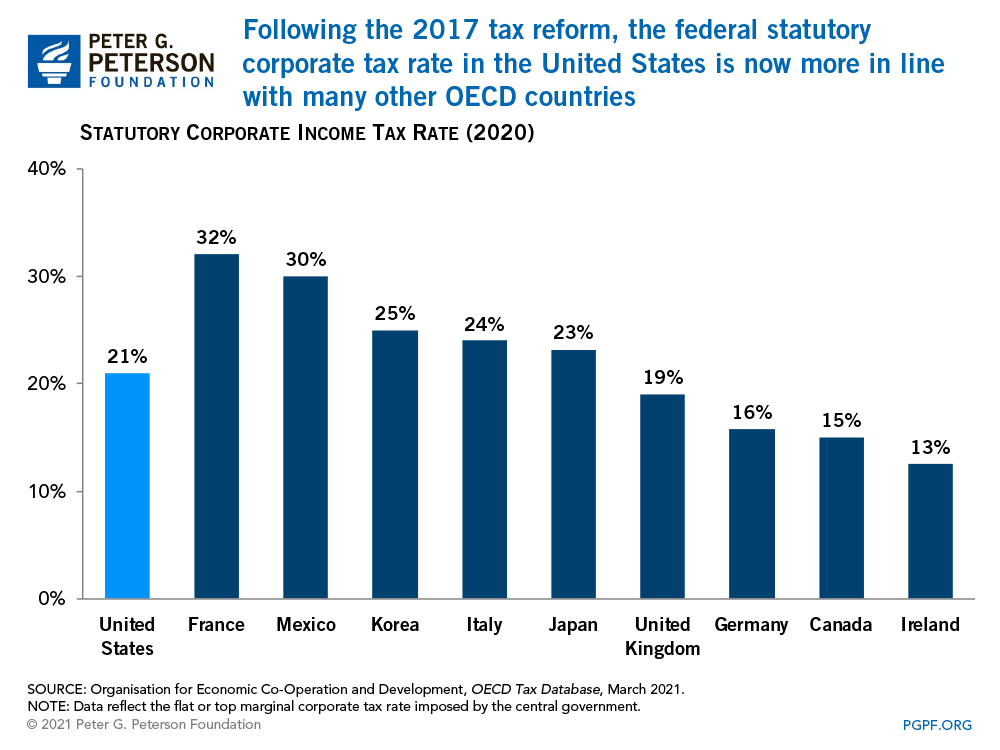

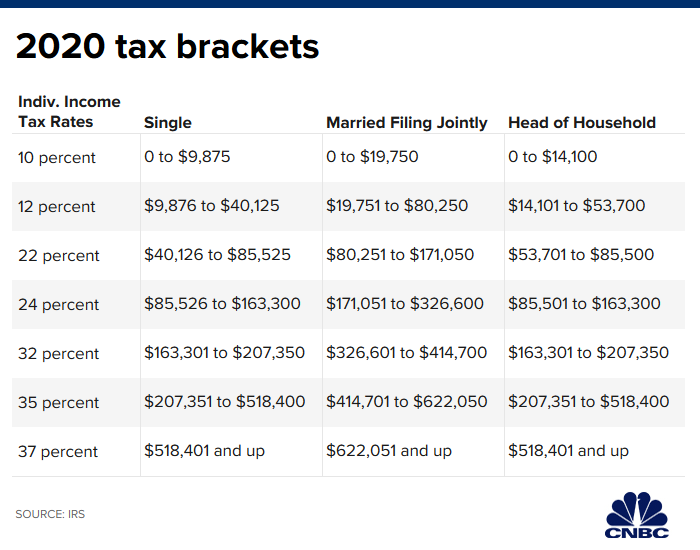

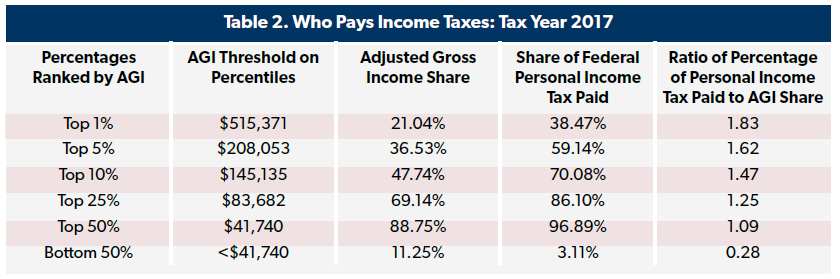

As of 2012, you pay federal income tax at 10, 15, 25, 28, 33 or 35 percent on wages over a certain. If you owe taxes, get a free consultation for irs tax relief. The rates depend on the taxpayer's tax bracket and the holding period.

Luckily, you can reduce the taxable income every year by contributing to your 401 (k). Your first step should be to make sure enough money is being withheld from your. 12 ways to lower your taxable income this year 1.

One way to do that is not to have the money in your possession at all. 6 ways to lower your taxable income save for retirement. Ad we have picked the top(5) tax relief companies out of 100's.

Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone. Increase your withholding so the government gets the money before you receive.

Open a health savings account. It will depend on your tax rate for the year based on your total income, filing status, deductions, and exemptions.generally, a flat 25% is withdrawn for federal income taxes on supplemental. Resolve your tax issues permanently.

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)