Inspirating Tips About How To Lower Credit Limit

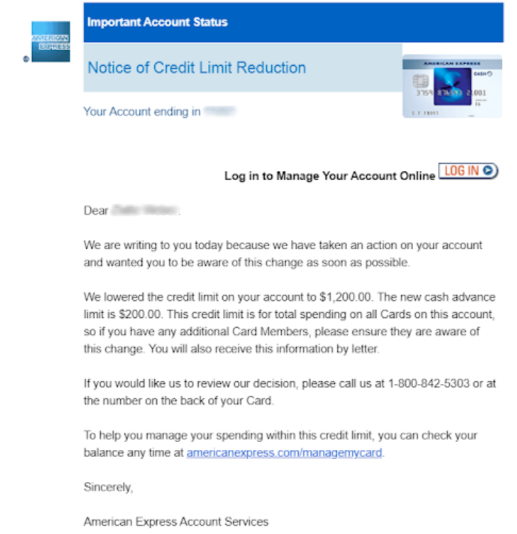

“a good first move is to contact the creditor to see if the old limit can be restored,” she.

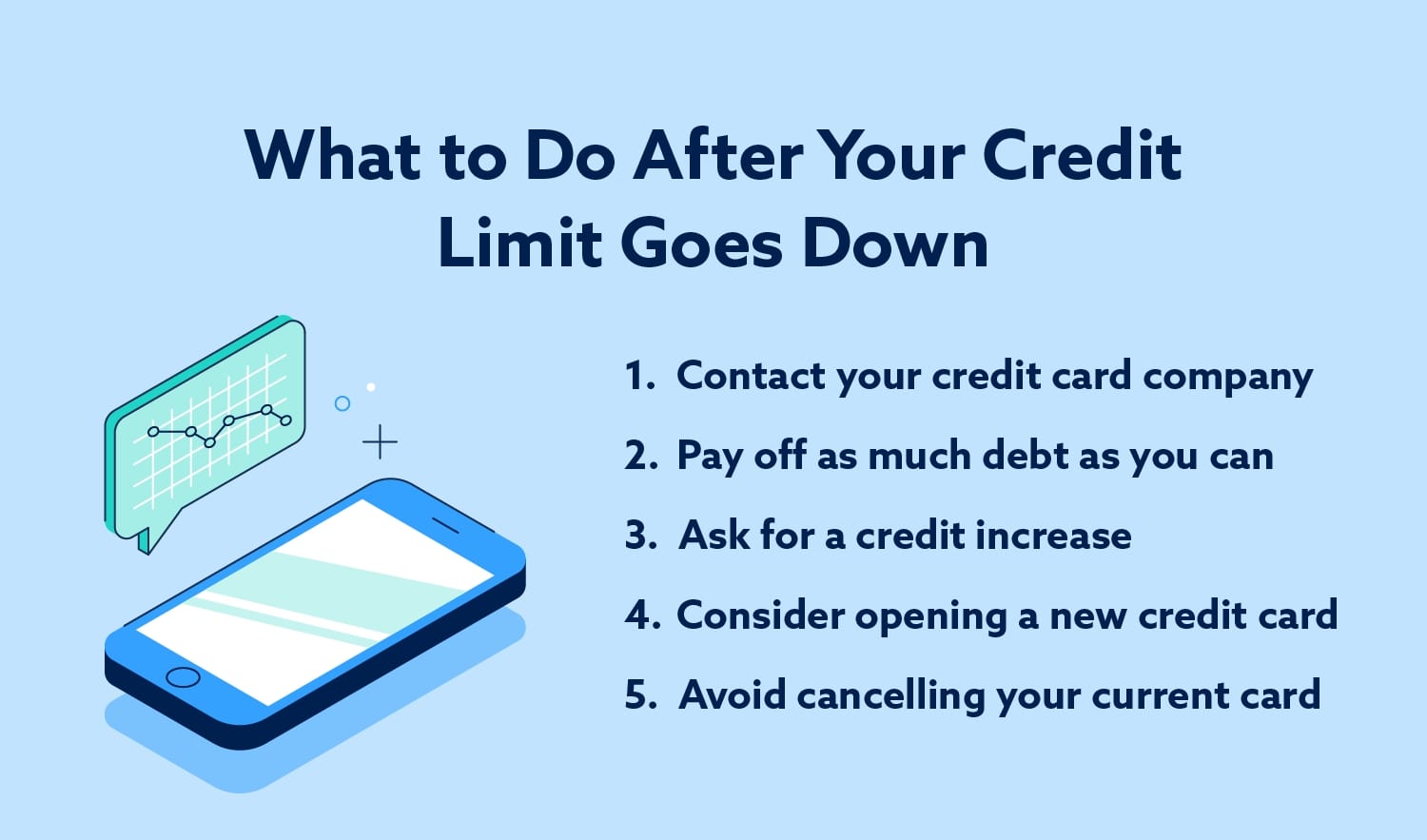

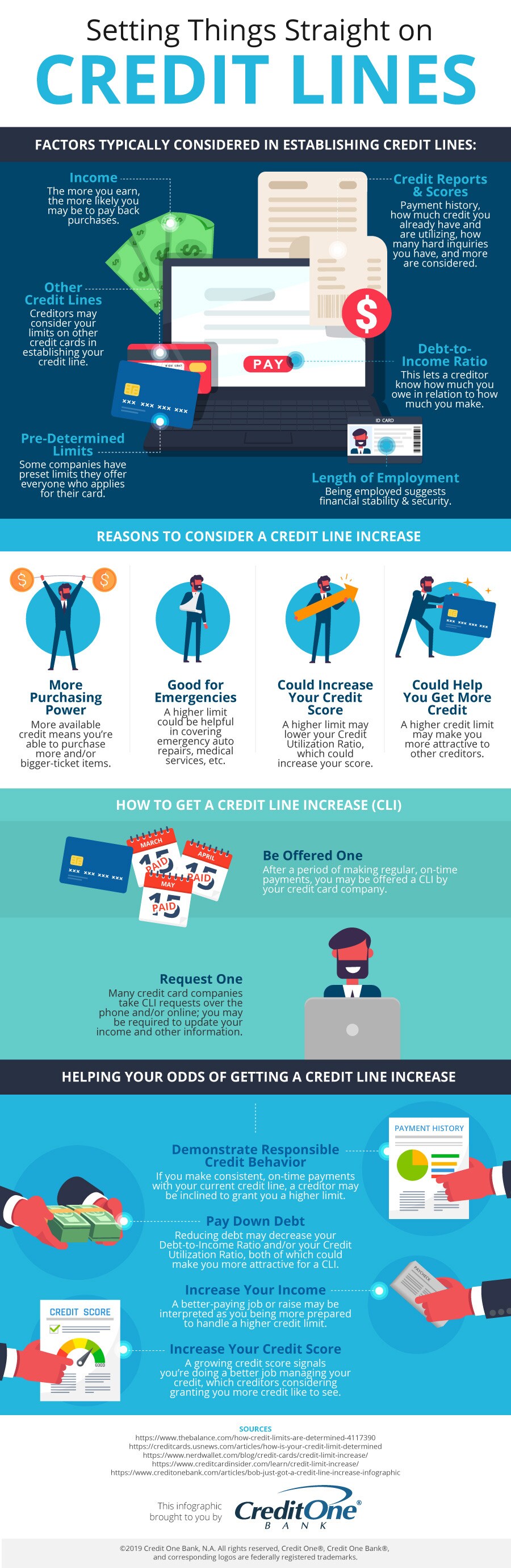

How to lower credit limit. How to reduce your credit limit. What options do i have to lower my credit utilization rate after the credit limit on my credit card or heloc has been changed? 3 steps to take if your credit limit is lowered 1.

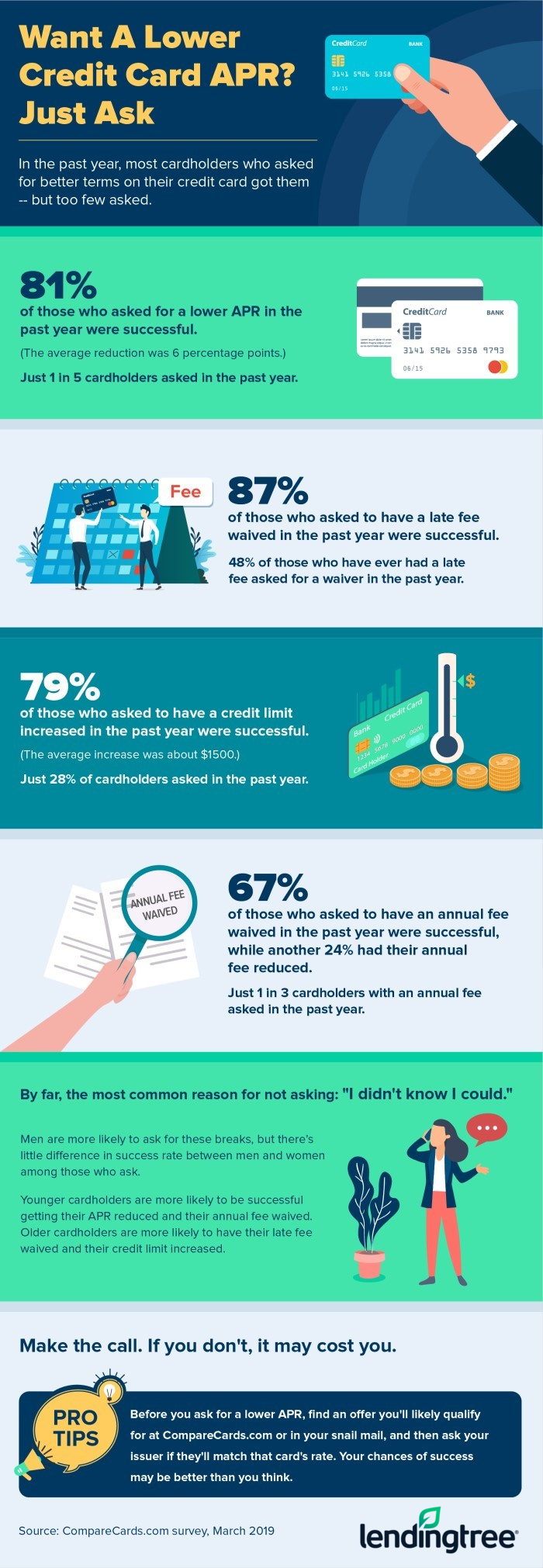

Instead, you can call your current credit card company and ask it to lower your limit to a. One strategy to offset the impact is to get a new balance transfer card and. Decrease the amount you put on a credit card each month or increase the amount of credit available to you.

Before you close any bank of america credit card it’s recommended to lower the credit limit at least a few days before you cancel. If your credit card company does suddenly cut your credit limit, there are some simple steps you can take. This however, limits your capacity to freely utilize your credit.

Issuers might cut credit limits to minimize risk in an uncertain. For example, if you have two credit cards with a total credit limit of $5,000, and your balance is $2,500, your credit utilization ratio is 50%. Utilization is calculated by dividing the total reported amount that you owe, by the total amount of credit available.

If you no longer have any available. Credit card customers love earning cash back from the purchases they make with rewards cards, and one recent survey found that nearly half of. Reach out to your lender or creditor and ask them to reinstate your.

Therefore, you should call your credit issuer and ask for them to reconsider, argues tayne. If you’ve weighed up the pros and cons and decided to reduce your credit limit, these are the steps you can follow to get started: Your credit card issuer can lower your credit limit at any time, regardless of how well you manage your account.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)