Exemplary Tips About How To Become A Certified Financial Planner In Canada

Becoming a certified financial planner in canada.

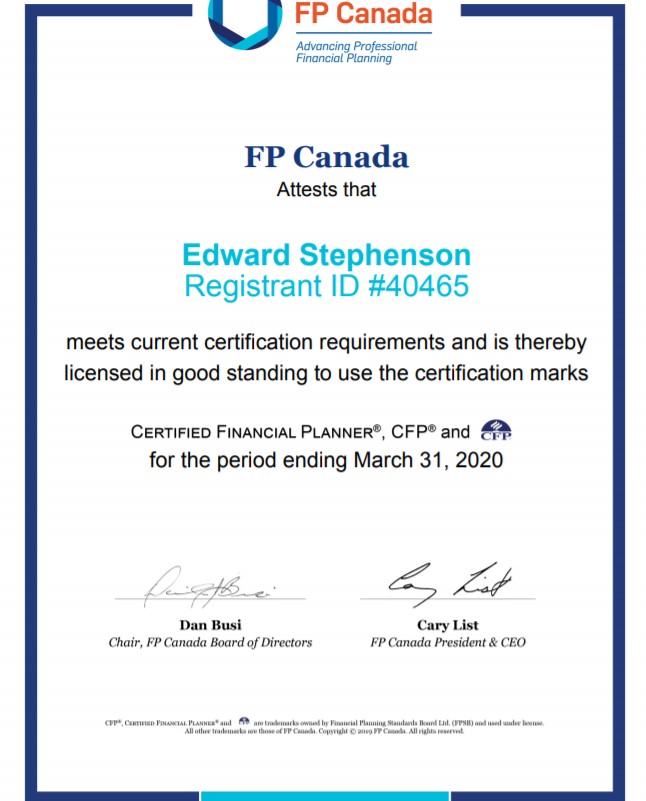

How to become a certified financial planner in canada. Qualified associate financial planner™ certification. Qafp™ certification is a great way to start your career in financial planning. To receive the cfp designation, each.

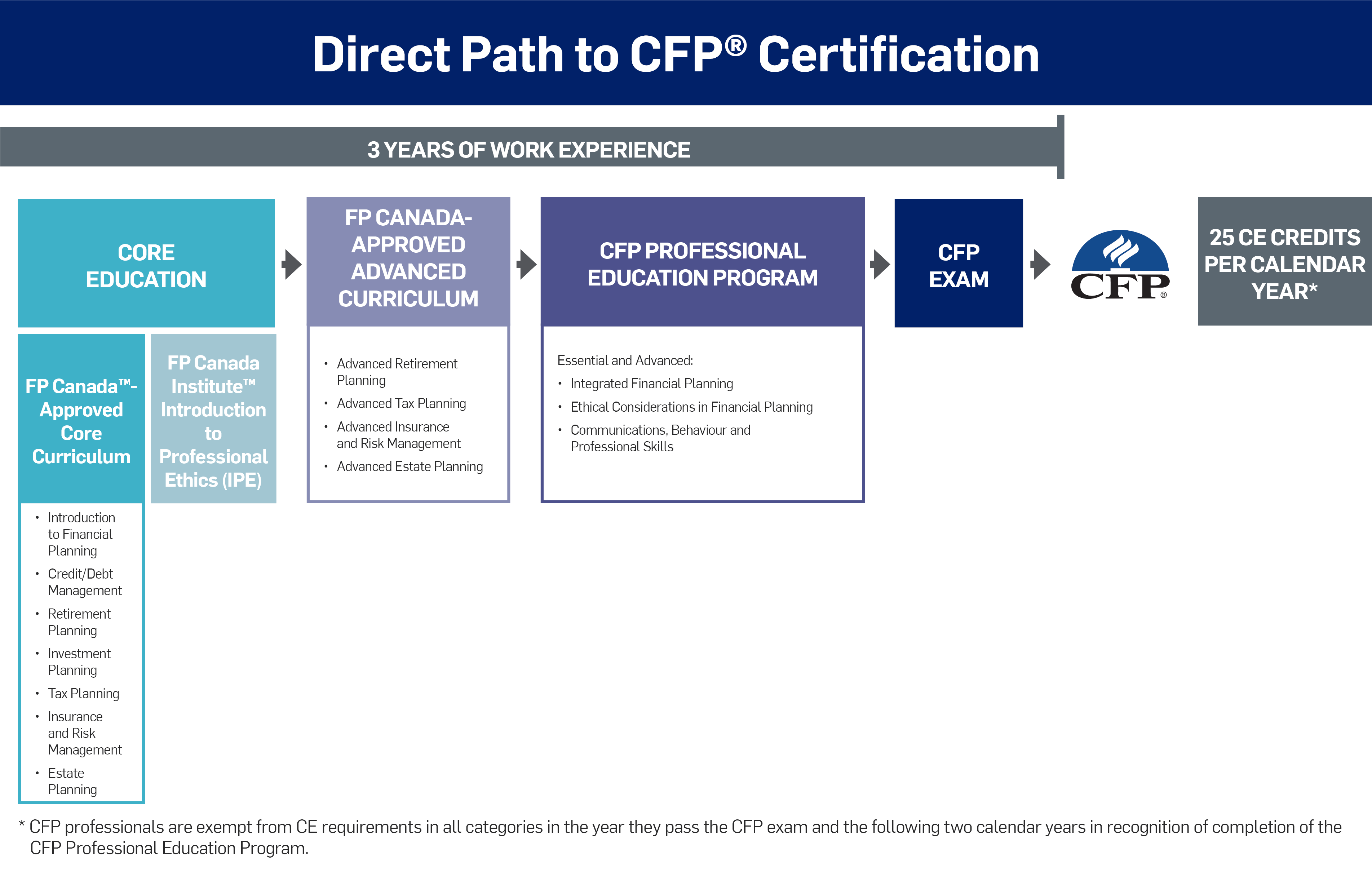

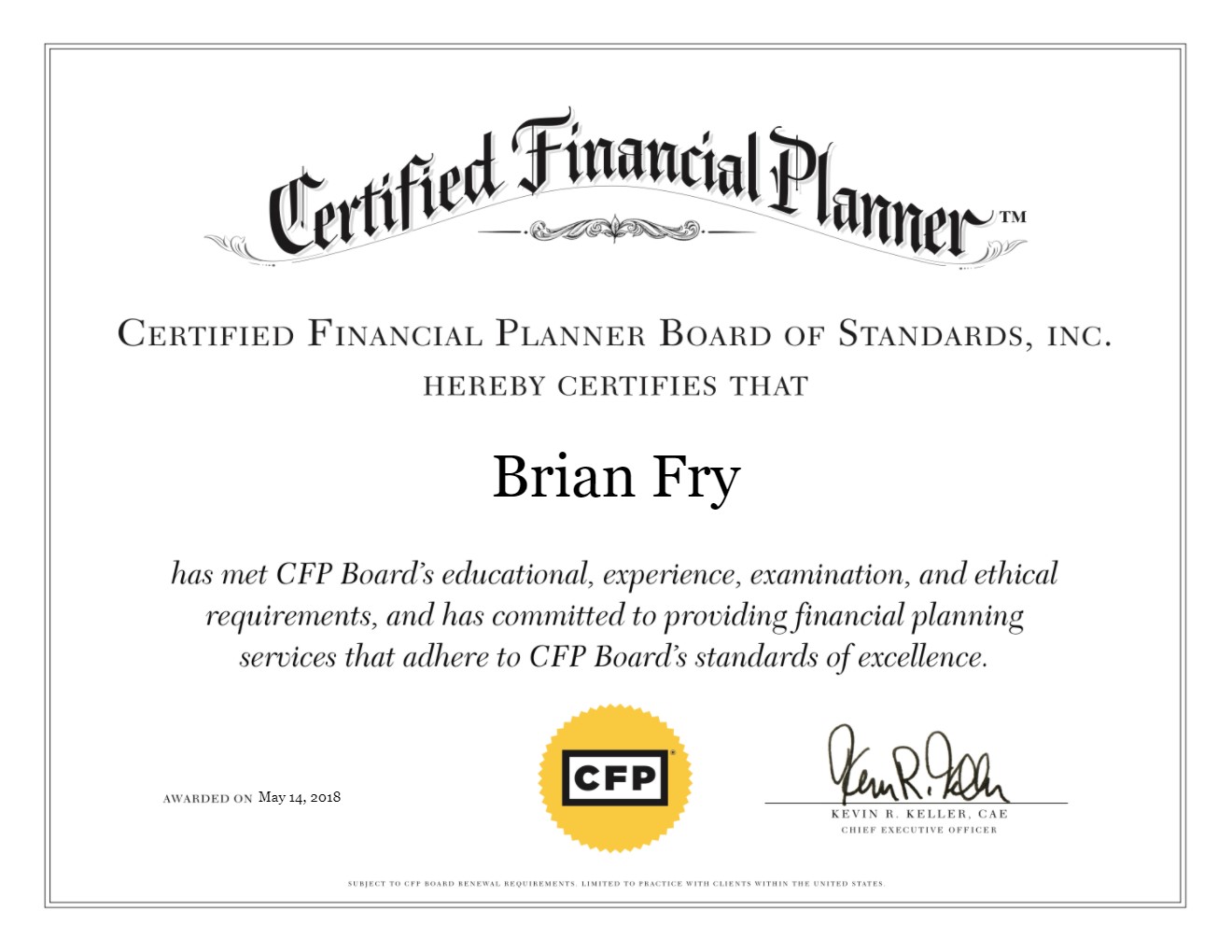

3) pass the cfp exam; You must hold cfp certification from a financial planning standards board (fpsb) member territory and submit an application for an alternate path to cfp certification. Since cfp certification is the standard for the industry across all of canada, the process is explained in detail here.

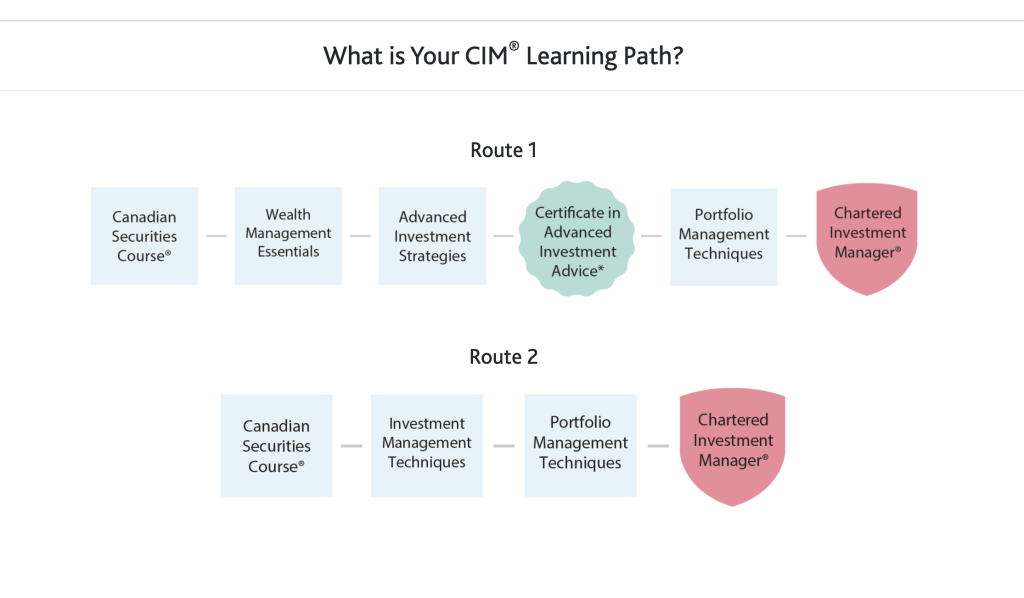

Obtain certifications in financial planning: Meet your securities licencing requirements. Canadian investment advisors have earned a college degree in business, finance, economics, or a.

Offered by fp canada, this certification enables you to. Becoming a financial advisor in canada. By pursuing a finance degree program and sitting for the industry exam, you can become a certified financial planner™, or cfp® professional, and help clients achieve.

4) complete either 6,000 hours of professional experience related to the financial planning process, or 4,000 hours of apprenticeship. Better understand your clients' unique financial needs and goals to build positive client relationships. Qafp™ certification provides a quicker path to becoming a professional financial planner, and it can be a stepping stone to earning your cfp certification.

Becoming certified as a financial planner in canada. Save $195 until september 30. Download becoming a certified financial planner in canada pdf/epub or read online books in mobi ebooks.